Discover the Potential of Your Investments

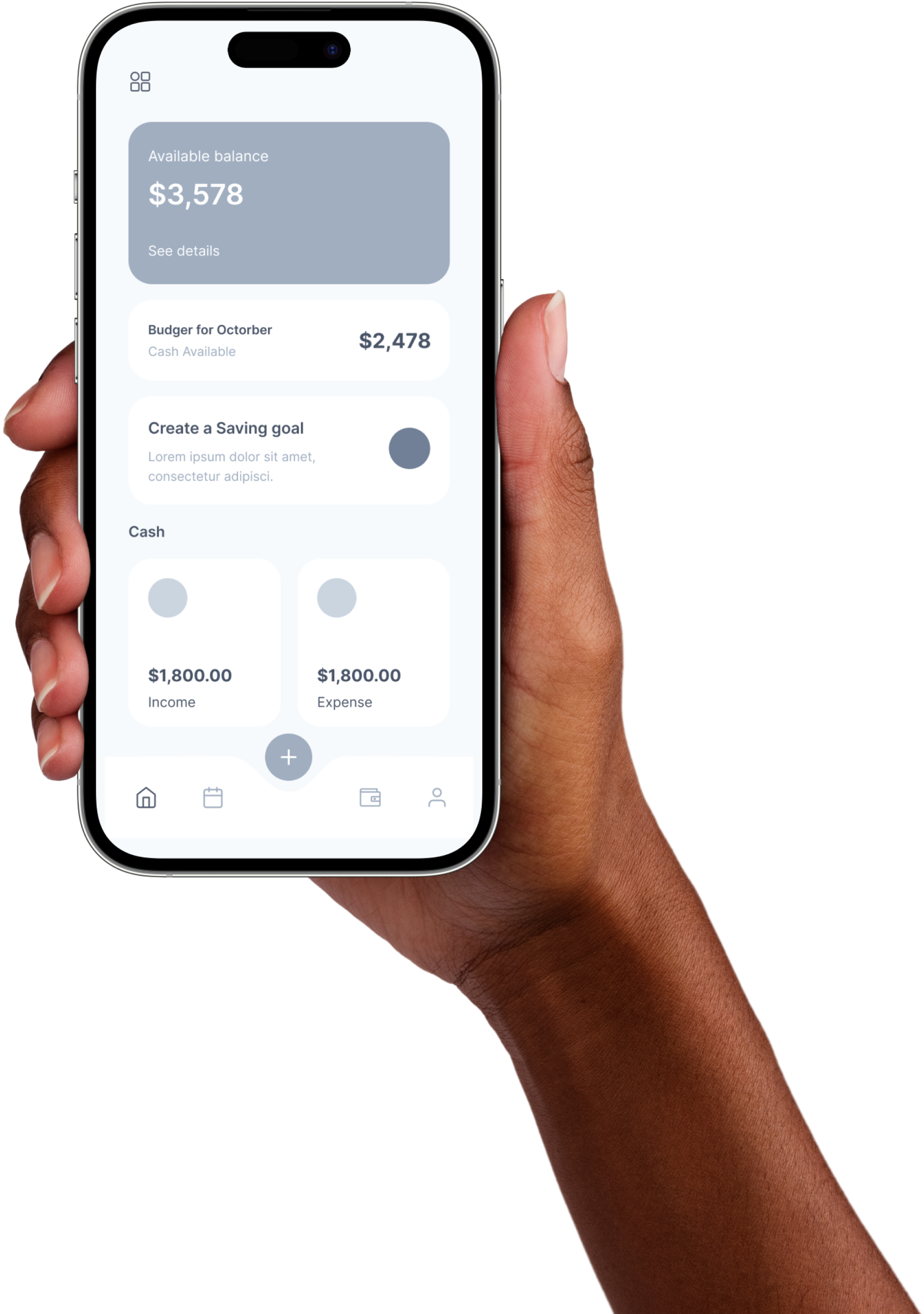

Get started with Sprout by downloading our app.

Link your Property & mortgage to create your Investment account with us to discover the true returns.

Calculated with Professional Precision

Discover the real value of your Property and Investments using our financial models made by investment professionals.

Leverage Al-optimized repayment strategies to reduce your mortgage faster while maintaining liquidity and diversification in your Investments through our models

Compare your returns to market growth with a detailed breakdown of your properties profits and costs.

Automated Payments and Decision-Making

Take control of your financial future.

Automate payments and Investments with our engine.

Move payments between mortgage payment and Investment with one swipe.

Exclusive access to our evidence-based and strong performance funds.

Simplifying Assets in One Place

Explore Our Frequently

Asked Questions

Find quick answers to the most common

questions about Sprout

Sprout is a financial platform designed to help homeowners grow their wealth by channelling surplus mortgage payments into diversified index investments, enabling financial growth beyond property ownership.

Sprout offers tools to calculate the real value of your property, simulate potential returns, and seamlessly make payments into index funds. It empowers you to diversify your portfolio, enjoy financial flexibility, and accelerate wealth building through compounding.

Diversification reduces risk and enhances growth potential by spreading investments across different assets. While property is a significant part of many portfolios, adding index funds provides stability and growth, leveraging the benefits of a balanced financial strategy.

Sprout combines property insights with investment tools in one platform. It allows you to manage your mortgage and investments together, helping you reduce your loan term and grow your wealth faster.

By leveraging the power of compounding through index investments, Sprout helps your surplus funds grow over time. The earlier and longer you invest, the greater your financial gains.

Yes, Sprout ensures you have complete control over your investments. You can access your funds as needed, providing financial flexibility for life’s surprises, such as career changes or family milestones.

In the unlikely event of this happening, all our clients would have their share of the segregated money or segregated assets returned, minus the administrators’ costs in handling and distributing these funds. Any shortfall of funds of up to £85,000 may be compensated for under the Financial Services Compensation Scheme (FSCS). The FSCS is the compensation fund of last resort for customers of authorised financial services firms. It is designed by the UK government to act as a ‘safety net’, and usually covers private investors (retail clients) and small businesses if they have been clients of a financial services firm which becomes insolvent.

Sprout emphasizes diversification by investing in index funds, which are designed to reduce risk by spreading investments across a wide range of assets. While no investment is entirely risk-free, index funds historically provide steady growth over the long term. Additionally, you maintain control and can access funds if market conditions change.

Start Building Wealth, Property & More

Sprout Your Financial Future Today